nj ev tax credit 2022

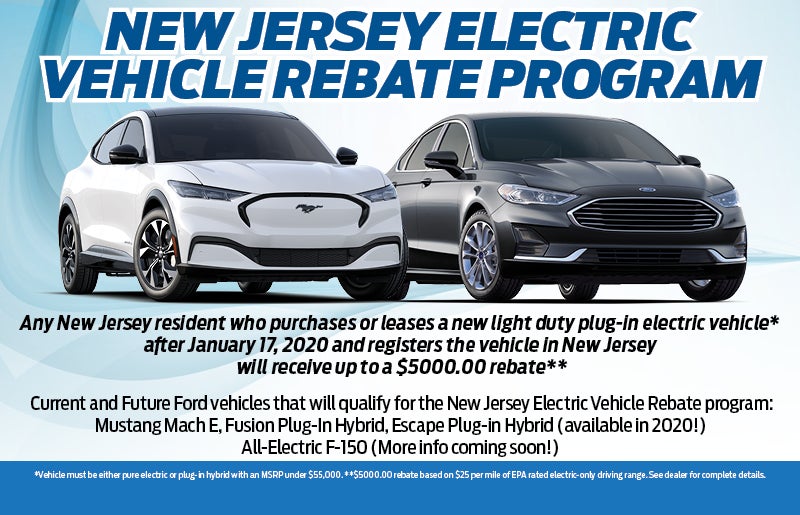

Combined with the federal tax credit of up to 7500 EV drivers in the Garden State were getting as much as 12500 off the sticker price of. Rebates are key to getting more EVs on New Jersey roads because the cars remain substantially more expensive than gas-powered vehicles.

Which Vehicles Qualify For An Ev Tax Credit In 2022 Getjerry Com

The Build Back Better bill will increase the current electric car tax credit from 7500 to 12500 for qualifying vehicles.

. Atlantic City Electric - NJ has a rebate program that covers residential EV chargers. Nj electric car rebate 2022. Ev tax credit new jersey 2022 23M views Discover short videos related to Ev tax credit new jersey 2022 on TikTok.

But for EV owners theres an appealing optionthe possibility of receiving an EV tax credit in 2022. The credit amount will vary based on the capacity of the battery used to power the vehicle. New Jersey must have received an Executive Order from the California Air Resources Board CARB certifying that the vehicles meet emission standards set forth in the.

The EV tax credit remains at 7500 for all electric models except those made by Tesla and General Motors. Keep in mindthere are certain vehicles that apply and some that dont. BMW 2020 i3 REX 168-223.

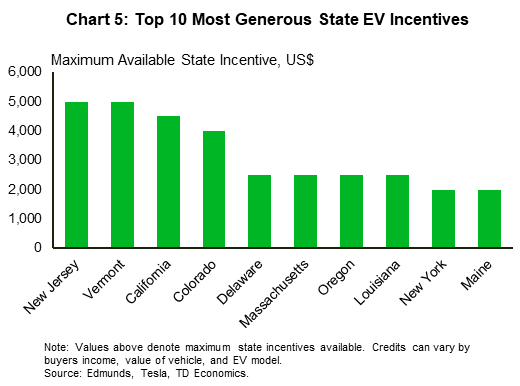

Federal tax credit for evs jumps from 7500 to up to 12500. TRENTON - The New Jersey Board of Public Utilities NJBPU opened Year 2 of its Charge Up New Jersey electric vehicle EV incentive program today taking one more step toward the Murphy Administrations goal of getting 330000 EVs on the road by 2025. 2022 145 100 45 2023 170 120 50 2024 195 140 55 2025 220 160 60.

January 1 2020 to december 31 2022. For vehicles acquired after 12312009 the credit is equal to 2500 plus for a vehicle which draws propulsion energy from a battery with at least 5 kilowatt hours of capacity 417 plus an. If youre ready to find your vehicle use the search below.

Local and Utility Incentives. Xcel Energy offers 500 Home Wiring Rebate for L2 Residential Charger. 1 for the taxpayers taxable year beginning in calendar year 2023 a taxpayer shall be allowed a credit against the tax otherwise due for the taxable year under the new jersey gross income tax act njs54a1-1 et seq in an amount equal to 25 percent up to 500 of the amount paid in that taxable year to purchase and install an electric.

Watch popular content from the following creators. Pay close attention though and youll know exactly which vehicles qualify for. Only 6 of those credits must be from pure electric vehicles.

Nj ev tax credit 2022. All-electric and plug-in hybrid cars purchased new in or after 2010 may be eligible for a federal income tax credit of up to 7500. This credit includes both the 7500 main credit plus another 500 for Tesla cars with American-made batteries House version or another 2500 Senate version.

Several months later it seems that revisions to the credit are returning to lawmaker agendas. Charge Up NJ EV Rebate NJ State Sales Tax 6625 Cost After Incentives. Theyve been screwing around with this EV.

Timing when Congress will come together to pass anything right now is as good as timing the market itself. The renewal of an EV tax credit for Tesla provides new opportunities for growth 2. Federal Tax Credits for New All-Electric and Plug-in Hybrid Vehicles Federal Tax Credit Up To 7500.

Electric Vehicles Solar and Energy Storage. New jersey drivers who have purchased or leased an electric car on or since jan. The program may close sooner if its budget is depleted before the deadline.

Xcel Energy offers income qualified customers 5500 rebate for new and 3000 rebate for used eligible electric vehicles in lieu of state tax credit. Because the 2022 credit will be a refundable tax credit probably 12500 in 2022 payable on my taxes in 2023 it cannot be used as a down payment in 2022. Updated 342022 Latest changes are in bold Other tax credits available for electric vehicle owners.

Fort Collins offers a 250kW incentive up to 1000 filed on behalf of the customer. President Bidens EV tax credit builds on top of the existing federal EV incentive. So im optimistic theyll get it.

Updated March 2022. Most Tesla cars sold starting on January 1 2022 would be eligible for an 8000 or 10000 credit. Most of the models you can order right now deliver in 2022 anyway.

The deadline to order purchase or lease an eligible electric vehicle was Wednesday September 15 2021. Audi 2021 e-tron 222. Beginning Today Customers Can Receive up to 5000 Incentive at the Point of Purchase.

The Charge Up New Jersey Program has been successful for the second year in a row. 4200 0 You Save 3010. However keep in mind.

While it wont apply to your 2021 tax return to the IRS it will potentially help save you on some tax costs in the future. After the failure of the Build Back Better bill in late 2021 the existing proposals for the expansion of the EV tax credit were abandoned. Badran Tax Accountingbadrantax zachshefskazachshefska zachshefskazachshefska Anna Wilkersonwilkernutting Mike Poarchmikealphastatus.

Internal Revenue Code Section 30D provides a credit for Qualified Plug-in Electric Drive Motor Vehicles including passenger vehicles and light trucks. What Is the New Federal EV Tax Credit for 2022. Eligible Vehicles Charge Up New Jersey.

In June 2021 New Jerseys Clean Energy Program NJCEP allocated a total of 7 million for Fiscal Year 2022 dedicating 6 million for use by state. You cant time anything based on Congress. The program is called ACE EVsmart Program The program is currently open with an expected end date of December 31st 2026.

0 0 You Save 4366 58400 Audi 2021 e-tron sportback. New Jerseys Energy Master Plan outlines key strategies to reduce energy consumption and emissions from the transportation sector including encouraging electric vehicle adoption electrifying transportation systems leveraging technology to reduce emissions and miles traveled and prioritizing clean transportation options in underserved communities to reach the. New jerseys energy master plan outlines key strategies to reduce energy consumption and emissions from the transportation sector.

0 You Save 3776 49500. So now you should know if your vehicle does in fact qualify for a federal tax credit and.

N J Wants To Pay You To Buy An Electric Vehicle But It Hasn T Said When It Will Resume Doing So Nj Com

Electric Vehicle Tax Credit For 2022 The Complete Guide Leafscore

The 12 500 Ev Tax Credit 2022 Everything You Need To Know Updated Yaa

Latest On Tesla Ev Tax Credit March 2022

Nj Electric Vehicle Rebate Program

Additional Incentives Charge Up New Jersey

Additional Incentives Charge Up New Jersey

J D Power First Time Owners Find Switching To Evs Highly Satisfactory Green Car Congress

Eligible Vehicles Charge Up New Jersey

Nj Resident Electric And Hybrid Vehicle Incentives Fred Beans Ford Of Langhorne

The 12 500 Ev Tax Credit 2022 Everything You Need To Know Updated Yaa

Eligible Vehicles Charge Up New Jersey

Which Vehicles Qualify For An Ev Tax Credit In 2022 Getjerry Com

Southern California Edison Incentives

2022 Washington State Ev Trends Electric Car Research

The 12 500 Ev Tax Credit 2022 Everything You Need To Know Updated Yaa

N J Wants To Pay You To Buy An Electric Vehicle But It Hasn T Said When It Will Resume Doing So Nj Com

Electric Hybrid Car Tax Credits 2022 Simple Guide Find The Best Car Price